A Brief History of… the Financial Services Industry

When I meet a new acquaintance and they ask me the pervasive “what do you do” question, I struggle with the best way to answer.

If I say something like “Financial Advisor” or “Financial Planner”, I know that the immediate reaction is to assume that I either sell commissioned products, such as loaded mutual funds and insurance, or solely give investment advice and recommendations.

Longer, more thorough answers are equally met with misunderstandings, especially for those that really don’t care!

Unfortunately, much of this confusion stems from the evolution of the Financial Services Industry over the last 50 years - and a lack of corresponding education for the consumers that these changes were meant to benefit.

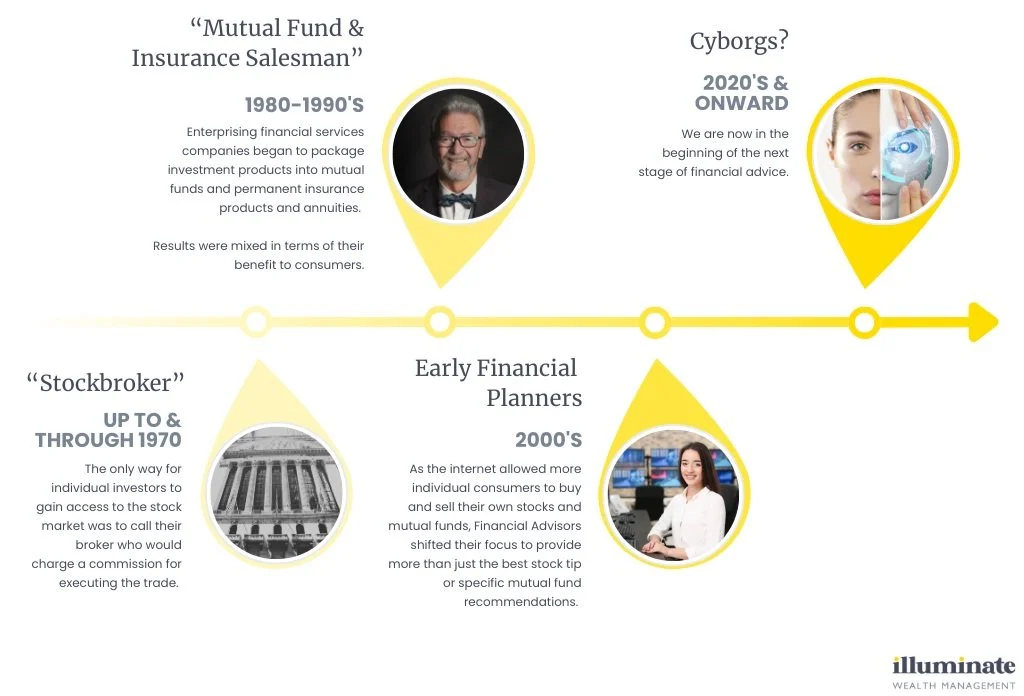

Let’s look at the 3 major shifts in the way that mass affluent and high-net worth consumers have been served, as well as a look ahead to what is likely the 4th major iteration of advice in the coming decade, including the integration of Artificial Intelligence.

The Evolution of the Financial Advisor

Up through 1970’s - Financial Advisor as “Stockbrokers”

In the first iteration of financial advice, financial advisors were synonymous with Stockbrokers.

The only way for individual investors to gain access to the stock market was to call their broker who would charge a commission for executing the trade.

This service was essential to expanding access to the upside of the stock market across the country.

Before May 1st, 1975, stockbrokers were paid a fixed rate of commission for every trade, regardless of the size. From the 1960s into the early 1970s, individual investors made up less and less of the market.

After “May Day”, brokerages had to compete with each other on commissions. This, along with technological changes, helped the stock market modernize and benefit individual investors.

1980’s-1990’s - Financial Advisors as Mutual Fund Salesmen and/or Insurance Salesmen

In the 1980s, enterprising financial services companies began to package investment products into mutual funds and permanent insurance products and annuities.

Rather than just pitching buying and selling individual companies, these mutual fund salesmen sold “portfolios” of stocks with professional managers.

The commissions for these mutual funds could be 5.75% or higher upfront (meaning that for every $1000 invested, $57.50 was paid to the mutual fund company and only $942.50 was actually invested). Additionally, with the evolution of 12b-1 fees, mutual fund salesmen began to receive ongoing `fees for their advice.

Arguably, this shift towards mutual funds was a major benefit to consumers as more investors accessed market returns and less uninformed trading occurred by individual investors.

Insurance salesmen also saw opportunity to package their boring life insurance products with exciting stock market returns. This included Whole Life (“Be Your Own Bank”), Variable annuities and Variable Universal Life (VUL) products. For instance, in 1986, the first VUL products became available.

These were permanent life insurance with stock market investments within the policy, allowing for significant upside, although with much higher fees. The insurance salesmen positioned a tax-deferred way to “have your cake and eat it too” by combining insurance with investments.

Unlike mutual funds, these new insurance products did not generally benefit consumers, but instead just made insurance salesmen even more money.

2000’s - Financial Advisors as Asset Allocators: with a recent addition of retirement planning add-ons such as Social Security timing tools and Safe Withdrawal Rates

Starting in the mid-1990s, but really accelerating in the 2000s was the growth of financial advisors pitching “diversified portfolios” of mutual funds.

As the internet allowed more individual consumers to buy and sell their own stocks and mutual funds, Financial Advisors shifted their focus to provide more than just the best stock tip or specific mutual fund recommendation.

This coincided with the rise of independent Registered Investment Advisor (RIA) companies (Illuminate Wealth Management is an RIA) using brokerages such as Schwab and Fidelity to custody client assets and hybrid models (such as LPL Financial).

The 2000s pitch to consumers was to provide advice on how to allocate your money between different types of investments so that clients could eventually retire around age 65.

Advisor compensation started to shift away from commissioned products and towards fees based upon Assets Under Management (AUM), especially with the creation of no-load mutual funds. This continued with the rise of ETFs in the 2010s.

The incentives in the industry lined up for the focus to be on gaining clients nearing retirement, as they had the most amount of money to bill on, especially with rolling over 401ks, and were approaching a major life transition.

As technology provided less expensive asset allocation options, and to further differentiate from other RIAs, forward-thinking firms began adding additional financial planning advice that was relevant to their retiree clients: Social Security timing tools, Safe Withdrawal Rate and tax-aware withdrawal strategies, Long-term Care insurance recommendations and Roth conversions in retirement. Even with the addition of some retiree financial planning recommendations, the primary focus remained on creating investment portfolios to reach retirement.

Compared to the advice before, consumers were generally served much better under this service model.

Today, an advisory firm without a national brand name is likely an RIA. These firms could range from a solo advisor with no support staff to a firm with hundreds of advisors and over $50 Billion in AUM. Regardless, the growth of this model was driven by a focus on diversified portfolios and a recent addition of “value-adds” around retirement to justify fees that haven’t changed with technological progress.

2020’s and On – Financial Advisor as ???

We are now in the beginning of the next stage of financial advice.

On one hand, it is very profitable for extremely large firms (such as Schwab, Fidelity, Major US Banks, Morgan Stanley, Edward Jones, LPL advisors, Northwestern Mutual) to focus on economies of scale and gather as much as possible in investable asse.

They will continue to focus on Asset Allocation Investment Advice, with a much smaller focus on any real Financial Planning (since it is more time-consuming and less scalable).

The name of the game will be how high is the AUM that can be billed on. The number of clients is irrelevant, only the total AUM across the firm to make money on. They will continue to hire Salespeople who will continue to be “Financial Planner” in name only.

Technology will continue to benefit clients of these companies, as better financial planning software tools will be at their disposal and the less skills “planners” can blindly follow software they don’t really understand.

On the other end, client-centric companies will lean into the opportunities to provide even more value to their clients. Towards the end of the 2010’s, a small subset of RIAs began focusing on expanding services beyond the typical “asset allocators”.

Covid accelerated this inevitable transition for many newer advisors, which will greatly expand the services available for clients, while also breeding additional confusion. No longer could a consumer hear the term “Financial Advisor” and have any idea what that meant.

Some smaller RIAs focused on underserved niches, such as student loan planning or flat financial planning with no investment advice. For instance, the XY Planning Network (XYPN) was created in the 2010s to help smaller firms serve younger Gen X and Gen Y clients with flat fees, that were historically overlooked by other firms.

Since COVID, XYPN has surpassed one thousand members, all doing flat, fee-only planning. As the 2020s continue, I expect additional specialization for nimble advisors to better serve their clients, but each firm in their own way.

The internet started, and COVID accelerated, the shift to virtual advice.

No longer do clients need to work with an advisor in their backyard. Instead, they can search for the BEST advisor for their specific needs. As smaller firms continue to specialize, there will be more options for consumers to find their right fit, regardless of geography.

What about those small and mid-sized independent companies that were established from mid-1990 on during the “asset allocator” decades (i.e. most RIAs)? They will have an important choice to make, either get really big, really fast to compete with the big brands or embrace the next generation of financial advice and remake their companies. Anything else will lead to a slow slog into obscurity and irrelevance.

I expect many RIAs will consolidate with the biggest players, rather than slowly die out.

2035: What about AI?

A part of this evolution is a technological shift that makes it difficult to predict the exact outcomes: the influence of Artificial Intelligence (AI) for the Financial Services Industry.

But, as I look ahead into the next 10 to 20 years, there are some general themes that further accelerate the bifurcation of the Financial Services Industry.

I see the three biggest things to keep in mind, all around the theme that “Incentives Matter”:

1. The big firms will follow the money, meaning they will look to boost profits in any way possible

2. As will almost all industries, AI will likely fully replace the “median” advisor while the top 10% will be made even better by incorporating AI

3. Technological process moves at an exponential rate, which is difficult for us to comprehend

The largest firms with the most AUM will look to reduce their biggest costs, which is the financial advisor and related labor costs.

Right now, AI already excels at completing mundane tasks such as filling out paperwork, so the first reduction in cost will be the administrative staff involved in account maintenance, such as opening new accounts, moving money, etc.

AI is close to mimicking human speech patterns, which will open the door to replacing most phone interactions. Within 5 years, I expect that when you phone into any call center, you, a) will not talk to a human and, b) you will not notice the difference.

You will no longer be placed on hold, as the AI call center will be able to have a full conversation with you, ask relevant questions and get answers faster, with no limit to the number of clients to serve at a time.

Current surveys suggest that consumers are hesitant to interact with AI, but the technology is changing so fast that I expect we will all soon be talking to AI solutions without us knowing.

The large firms will focus on replacing their “Financial Advisors” by incorporating AI into the entire advice process.

Companies such as Edward Jones or Chase Private Client will take all the financial plans that have ever been developed in their company and teach AI how to build a standard financial plan. Then, by incorporating the speech models, they will be able to deliver a financial plan over Zoom to each specific client and answer any questions that the consumer may have.

They will (truthfully) be able to say that they have taken the best advice that they have to offer and incorporated the specific client into a better plan than their individual advisors would have been able to do on their own. Even when investment markets are scary, the speech model will be able to convey empathy in a way that calms the fears of their clients, the same way their current human advisor does.

There will almost certainly be a focus on incorporating AI into investing, to the point that I would not be surprised if all the largest mutual funds are AI driven trading tools. Almost the entire volume of trades each day will be AI placed trades and markets will become more efficient overall.

One secondary effect could be that more companies decide to privatize or stay private longer, since the AI trades cannot access these company shares.

Overall, individual investors will have access to more efficient returns at a lower fee.

There will also be an increased interest in investing outside of the public stock market, whether that is in private equity or individual real estate.

For the smaller, more personalized financial advisors, they will incorporate AI into their businesses to enhance their ability to serve their clients. In the short-term, this could be incorporating AI image generation to help clients better envision their retirement years, or maybe using AI to streamline their account maintenance process.

50% of existing Financial Advisors are projected to retire in the next decade, and there are not enough young advisors in the pipeline to replace them. AI and other technology will likely fill this gap (and then some).

Where does Illuminate fit into the future of financial planning?

Illuminate Wealth Management is an RIA, but we were founded intentionally looking ahead to the next evolution of financial advice.

We are committed to providing an ultra-premium, white-glove service to our clients.

This means that we CANNOT focus on growing for growth’s sake and risk diluting our service to our clients. We are NOT looking to “get really big really fast” and compete with national brands.

Instead, we must embrace all the best practices from both the client-centric firms in the industry as well as look outside Financial Services for inspiration for additional ways to serve our clients.

In practice, this means that our business will look different five, ten and twenty years from now, all with a focus on serving our clients better..

I do not know exactly what things will look like, but I am excited about the opportunities to serve our clients in a deeper way!